Access Differentiated Alpha in

Niche Global Markets

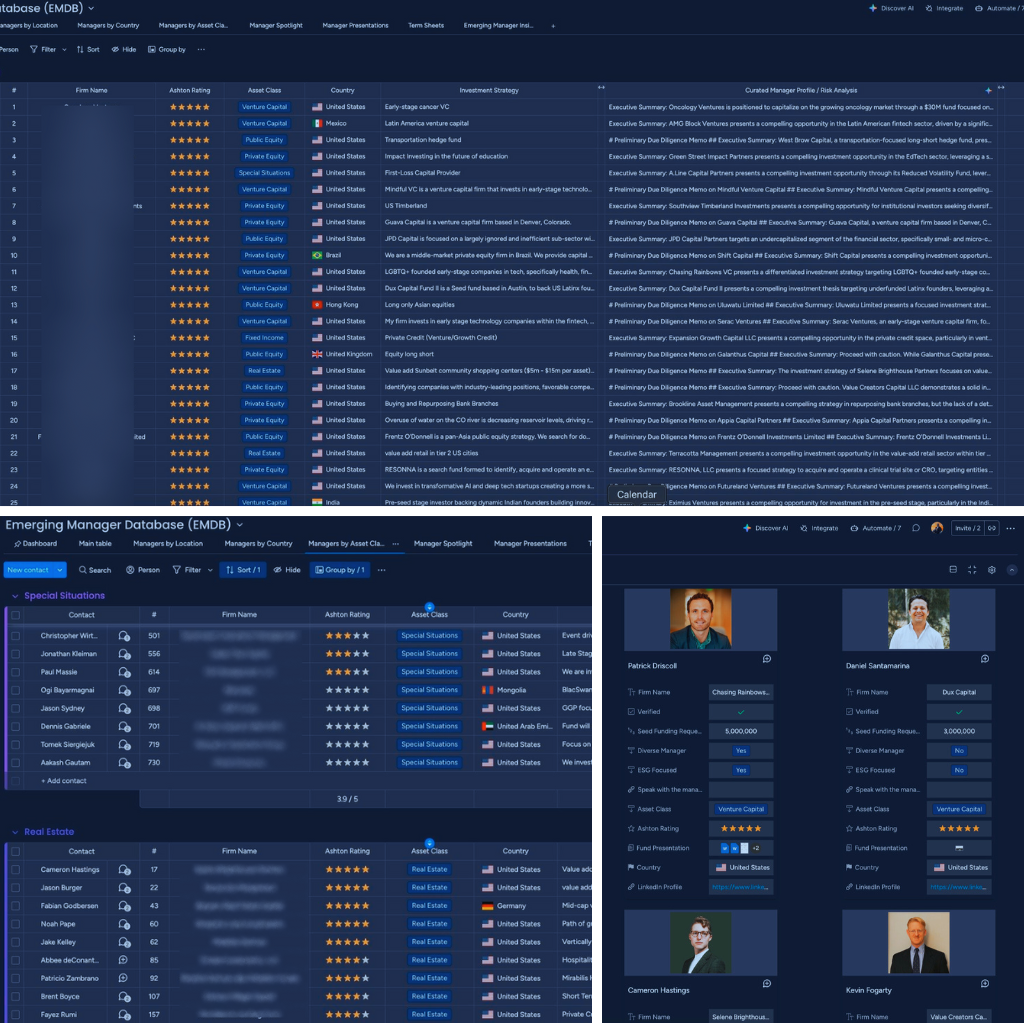

AlphaSeek is the institutional platform connecting family offices and foundations with a curated universe of over 1,000 emerging managers specializing in non-correlated, hard-to-access strategies.

Deploy Capital With Efficiency and Conviction

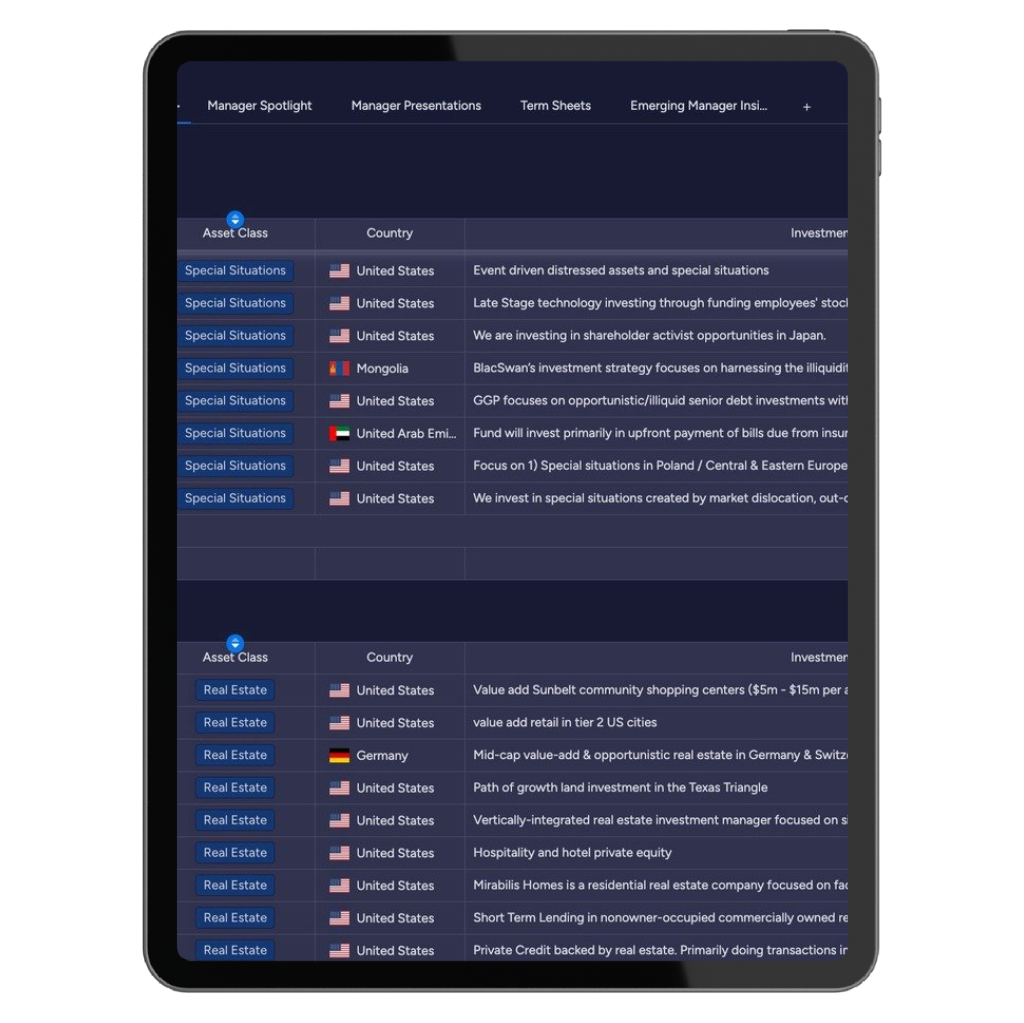

Gain priority access to a global pipeline of over 1,000 vetted managers specializing in unique strategies like public and private equity, real estate, litigation finance, and private credit. Our platform enables you to source opportunities in high-growth, underserved markets that are beyond the reach of traditional networks.

Discover Untapped Alpha Through Geographic Arbitrage

Deploy capital where competition is lower and the potential for alpha is higher. Source unique opportunities across the entire alternatives spectrum, including in the United States, Europe, Latin America, Africa, and Asia, all on one unified platform.

Leverage Institutional-Grade Due Diligence

Our proprietary Ashton Rating™ system and expert due diligence professionals save your team hundreds of hours in screening and analysis. We provide the institutional diligence and transparency required for confident cross-border investing in private markets, overcoming the challenges of distance and complexity.

Streamline Your Sourcing and Capital Deployment

Execute investments into emerging managers with ease and security. Our integrated platform streamlines the entire process—from discovery and due diligence to executing documents—creating a secure, auditable trail for every allocation. Our proprietary Ashton Rating™ system and embedded diligence files save your team hundreds of hours in screening and analysis.

Our Commitment to Institutional Rigor

Our team's experience stems from Cambridge Associates, the world's largest institutional investment consulting firm. Every manager on the AlphaSeek platform undergoes a multi-stage diligence process managed by our expert investment team.We combine technology-driven screening with deep qualitative analysis to ensure every opportunity meets the highest institutional standards. This rigorous methodology provides you with a trusted foundation for your diligence, giving you peace of mind when investing in alternative assets.

Your Path to Global Alpha

1. Request a Confidential ConsultationBegin by requesting access. Our streamlined onboarding allows you to define your unique mandate, from financial return targets to specific investment policy.

2. Explore Global AlphaLists™Explore our proprietary AlphaLists™—curated selections of vetted managers organized by strategy, geography, and theme. Filter compelling opportunities that meet your mandate in minutes, not months.

3. Connect and Allocate SecurelyEngage directly with managers through our secure virtual data rooms. Our platform provides a seamless, auditable trail from introduction to allocation, ensuring complete transparency and governance.

Family Office in Switzerland

"Using Ashton Global's fintech platform has drastically reduced our time to find long-short hedge fund managers. It is a must-have tool for any family office."

John C., Ayaltis

US Hedge Fund

"Amazing job! I've streamlined capital deployment and found some really good managers."

Eric S., New York Hedge Fund

Multi-Family Office in London

"Brilliant team at Ashton Global. Wonderful platform with actionable real-time data."

Haris J., UCEA

Family Office in Mexico

"AlphaSeek is amazing for family offices looking for investments in the US, or with US companies and fund managers. I highly recommend."

Rodolfo R., Holland & Knight

Gain Your Global Information Edge.

The most successful investors of the next decade will be those who leverage technology to access differentiated strategies without compromising on returns. Partner with Ashton Global to unlock new sources of alpha.

Frequently Asked Questions

1. What is the onboarding process for a family office?

Our process begins with a confidential consultation to understand your specific goals for international diversification. Upon approval, your team signs a single digital NDA to receive full platform credentials, typically within 48 hours.2. How does the platform help manage currency risk?

While AlphaSeek is not a currency-hedging tool, it provides direct access to investment opportunities denominated in stable, hard currencies such as the US Dollar and the Euro.3. Do you offer bilingual support?

Yes. Our platform, client support teams, and investment directors are fully bilingual in English, Korean, Portuguese, and Spanish. We are committed to providing a seamless, high-touch experience with clear communication for our clients.4. How are managers vetted for the platform?

Every manager on the AlphaSeek platform undergoes a multi-stage diligence process managed by our expert investment team. We combine technology-driven screening with deep qualitative analysis to ensure every opportunity is financially sound and meets the highest institutional standards. Our multi-stage vetting process includes data verification, background checks, compliance reviews, and a qualitative interview with our investment directors. This rigorous process ensures a high-quality, curated universe of global managers you can trust.

© 2026 Ashton Global Alphaseek. All rights reserved.The information provided on the Ashton Global AlphaSeek website, including any data, profiles, and materials related to emerging managers, is for informational purposes only. It should not be construed as investment, legal, tax, or financial advice. Ashton Global does not endorse any specific manager or investment opportunity. We strongly recommend that you conduct your thorough due diligence and consult with your independent financial and legal advisors before making any investment decisions.